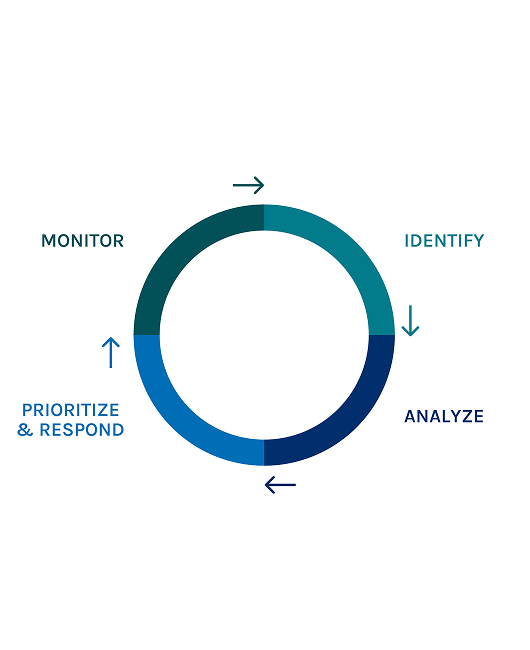

The aim of ERM is to guarantee an effective identification, analysis and control of the main risks to which the Acea Group, owing to the nature of its business and the strategies adopted, is potentially exposed, ensuring that the Group’s overall exposure is consistent with the Business Plan and Sustainability objectives.

The ERM Framework, which aims to enhance the integrated vision of risks and their proactive management, is intended to:

- show the nature and relevance (probability and economic-financial and/or reputational impact) of the main risks, with implications also in terms of sustainability issues, that might compromise the achievement of the Group’s strategic and business objectives;

- steer the response strategies and the consequent additional mitigation actions.